COVID-2019 status

The COVID-19 corona virus pandemic has significantly impacted global health and mortality. As of 15 April 2020, there has been 210 countries and territories affected. There are more than 2 Million positive cases and 135 thousand deaths (for up to date detail, see here).

Policy Responses to COVID-2019

To fight the outbreak and the spread of the virus, countries are imposing unprecedented measures, such as restrictions on the free movement of people and goods, and are shutting down large parts of the economy.

This results to a sharp fall in economic activity around the word. In order to protect businesses and people from the economic disruption, Governments have put in place a number of measures through fiscal policy, monetary and macro-financial policy, exchange rate and balance of payment. Among these are tax cuts, investment incentives or changes to filing deadlines, tax systems.

In March 2020, OECD also advised a range of tax policy and tax administration measures. These are intended to assist administrations globally in their consideration of appropriate measures. The measures focus on easing burdens on taxpayers and support businesses and individuals with cash-flow problems or with difficulties in meeting tax reporting or payment obligations. Namely:

+ Defer payments of VAT, customs or excise duties for imported items

+ Speed up refunds of excess input VAT

+ Simplify procedures for claiming relief from VAT on bad debts

+ Defer or waiving taxes that are levied on certain tax base

+ Increase the generosity of loss carry-forward provisions

+ Prepare for recovery including through tax policy

+ Waive or defer employer and self-employed social security contributions, payroll related taxes

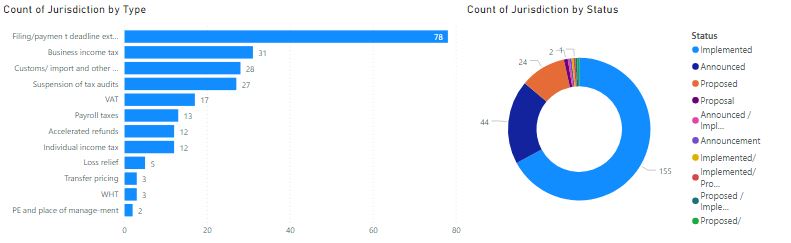

COVID-2019 International Tax Development Summary Analysis

Given there is abundance of new international tax developments , DaTaxan helps put all together in a single page, interactive COVID-19 INTERNATIONAL TAX DEVELOPMENT SUMMARY ANALYSIS to help you stay on top of worldwide tax policy response to coronavirus pandemic.

The data source of report is from KPMG on-going updated COVID-2019 Tax Development Summary report. The report will be refreshed regularly to bring you up to date information.

So far, extension of tax payment and filing deadline is the most popular measure. United States, Australia, Croatia and South Africa have the most number of measure types proposed, implemented.

*Note: The report is not meant for comparison across jurisdiction as responses vary depending on the nature of the shock from the novel epidemic and country-specific circumstances.