World Corporate Income Tax rate (“CIT”) analysis

Corporate Income Tax rate (“CIT”) is one of the key factors that impact Tax charges of a business. We would like to bring you an overview of the tax rate in various countries, regions around the world over the past decade.

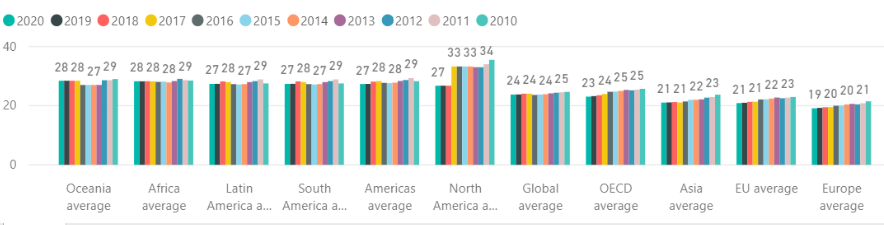

As you can find in our interactive analysis report and below snapshot, the CIT rate continues the down trend in 2020. Europe has been the region having lowest CIT rate over the period, following by Asia. With the recent US tax reform, the US headline tax rate dropped significantly and helped reduce the average CIT rate of the North America region.

Interactive CIT analysis report

Let’s do some more analysis with our below interactive Power Bi report

The top left table shows 2020 tax rate by country in world map.

The top right table shows Scatter chart of tax rate 2020 vs previous years. Click Play button I> to view the changes by year

When we play the scatter chart, we find more dots (tax rates) moving down vs moving up over the years. This indicates the trend that more countries have reduced vs increased the rates over the period.

You can also filter the year(s), jurisdiction(s) you like to view.

Let’s us know your thoughts in the below comments. Why not Sign Up to get more insights!