Multilateral instrument (“MLI”) Overview

Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (“Multilateral Instrument” or “MLI”) is part of BEPS actions from OECD.

The MLI modifies the application of thousands of bilateral tax treaties concluded with an aim to implement agreed minimum standards to counter treaty abuse and to improve dispute resolution mechanisms while providing flexibility to accommodate specific tax treaty policies.

According to OECD, as of 29 June 2021, The MLI already covers 95 jurisdictions and entered into force on 1 July 2018.

UK, Sweden, New Zealand are among the 9 countries having the MLI entered into force as early as 2018. 24 more countries had MLI entered into force in 2019, namely France, Netherland, Singapore… Latvia, Mauritius, Iceland and Denmark are the recent countries get MLI entered into in force – early 2020.

| Notified and Matched agreements on 29 June 2021 | with duplication | without duplication |

|---|---|---|

| Notifying Jurisdictions | 95 | 95 |

| Notified Agreements | 4,556 | 2,843 |

| Matched Agreements | 3,426 | 1,713 |

| “One-Way” Agreements | 224 | 224 |

| “Waiting” Agreements | 906 | 906 |

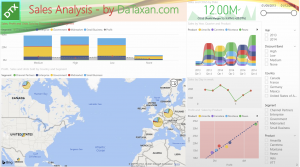

Interactive MLI Analysis report

The below interactive Power Bi flow map will give you a quick over overview of world’s implementation status of Multilateral Convention.

The first page offers an overview of Country MLI status and network. Simply select any jurisdiction to get a dynamic flow map and clear list of matching MLI jurisdictions with entry into force dates.

The second page provide MLI matching tool for selected jurisdictions with auto define Covered or Not Covered Tax Agreement and details of their Reservation and Option by Article, Paragraph, Sub-paragraph and Clause

This report data source is updated as at 29 June 2021

For live update version, please visit https://dataxan.com/product/multilateral-instrument-mli-matching-tool-with-live-oecd-data-update/

Source: https://www.oecd.org/tax/beps/country-by-country-exchange-relationships.htm

Annex: Main articles of the MLI

| Article 2 | Covered Tax Agreement |

| Article 3 | Transparent Entities |

| Article 4 | Dual Resident Entitities |

| Article 5 | Application for methods for Elimination of Double Taxation |

| Article 6 | Purpose of a Covered Tax Agreement |

| Article 7 | Prevention of Treaty Abuse |

| Article 8 | Dividend Transfer Transactions |

| Article 9 | Capital Gains from Alienation of Shares or Interests of Entities Deriving their Value Principally from Immovable Property |

| Article 10 | Anti-abuse Rule for Permanent Establishments Situated in Third Jurisdictions |

| Article 11 | Application of Tax Agreements to Restrict a Party’s Right to Tax its Own Residents |

| Article 12 | Artificial Avoidance of Permanent Establishment Status through Commissionnaire Arrangements and Similar Strategies |

| Article 13 | Artificial Avoidance of Permanent Establishment Status through the Specific Activity Exemptions |

| Article 14 | Splitting-up of Contracts |

| Article 15 | Definition of a Person Closely Related to an Enterprise |

| Article 16 | Mutual Agreement Procedure |

| Article 17 | Corresponding Adjustments |

| Article 18 | General applicability of Part VI (Arbitration) |

| Article 19 | Mandatory Binding Arbitration |

| Article 23 | Type of Arbitration Process |

| Article 24 | Agreement on a Different Resolution |

| Article 28 | Reservations on the scope |