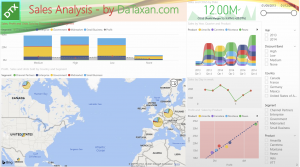

CbCR – Country by Country Reporting status analysis

The OECD has shared information on the domestic legal frameworks for CbCR (under BEPS Action 13) around the world at a high-level snapshot for tax administrations and MNE Groups as to:

- The first reporting periods

- Availability of surrogate filing including in the parent jurisdiction

- Local filing under CbC Multilateral Competent Authority Agreement (CbC MCAA) from The Inclusive Framework on BEPS (OECD)

- Requirements to notify the jurisdiction’s tax administration of whether a CbC report will be filed.

As of Apr 2020, 77 jurisdictions have put the CbCR in place and 69 out of these have had exchange network activated.

There are only few countries having CbCR domestic law in place but not having exchange network activated like: Vietnam ,Kazakhstan.

Interactive report

In addition, OECD also published a link that shows all bilateral exchange relationships that are currently in place for the automatic exchange of CbC reports between tax authorities.

Should you need any support regarding CbCR, feel free to contact us.