Vietnam New Transfer Pricing Decree – 132/2020/ND-CP

On 5 November 2020, the Government has issued Decree No.132/2020/ND-CP (“Decree 132“) to replace 20/2017/ND-CP (“Decree 20“) and Decree No. 68/2020/ND-CP (“Decree 68“) prescribing tax administration for enterprises engaged in related party transactions.

Some prominent points in this Transfer Pricing regulations under Decree 132 are:

1.Regulations on deductible interest expenses

Inheriting the provisions of Decree 68, Decree 132 regulates deductible Interest cap at 30% EBITDA for businesses engaged in related party transactions as well as other specific provisions on carrying forward non-deductible interest expenses or the retroactive application for the period of 2017-2018.

2. Narrowing the arm’s length range to the 35th percentile – the 75th percentile

Under Decree 132, the arm’s length range is now defined as to be from the 35th percentile to the 75th percentile. Namely, the lower threshold has increased from the 25th percentile to the 35th percentile.

3. Country-by-Country reports (“CbCr”)

New and revised provisions relating to the preparation and submitting of CbCr are stipulated in Clause 5, Article 18, Decree 132. Specifically:

- Timeline for submission of CbCr for taxpayer in Vietnam being Ultimate Parent Company (with more than VND18,000 billion consolidated revenue): 12 months after the end of the fiscal year of ultimate parent company.

- Guidelines to cases Ultimate Parent Company of the tax payer in Vietnam is required to submit CbCr in its country of residence with and without automatic information exchange International Agreements with Vietnam.

- For taxpayers whose Ultimate Parent Company is not required to submit Country-by-Country reports according to the regulations of its country of residence, provisions under international tax treaties shall be applied.

4. Commercial databases to be used as comparables for benchmarking purposes

The data sources used as comparables for benchmarking purposes are no longer limited to databases provided by information business organizations extracted from publicly available sources.

Decree 132 has expanded its information source for collecting financial and economic data used in benchmarking analysis to commercial databases.

5. Deadline for provision of TP Documentation during tax audits

According to Decree 132, the deadline for provision of Transfer Pricing Documentation as required by the tax authority during tax audits and inspections shall be determined in accordance with the Law on Inspection.

6. Effective date

Decree 132 takes effect on 20 December 2020 and is applied for the tax period of 2020 onwards.

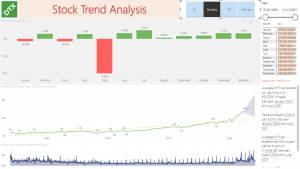

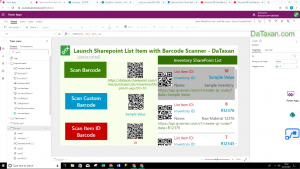

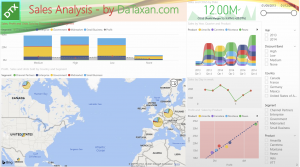

You may like a stress test of the groups transfer pricing through interactive data visualizations that effectively highlight your MNE’s CbCr, and enable your MNE to timely perform appropriate adjustments to its global CbCr profile.

View Free Transfer Pricing World Map Analysis here

The CbCR Risk Assessment Tool also allows Group to benchmark its own CbCR with OECD’s recent released Anonymised & Aggregated CbCR data

DaTaxan has all covered for you with our Power BI Transfer Pricing CbCr templates

Should you need any additional or related information regarding this Decree 132, feel free to reach out to us at contact@dataxan.com