Worldwide Tax rates Analysis

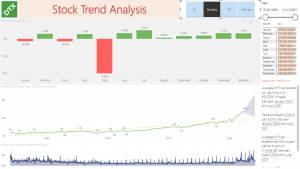

Tax rules and regulations around the world continue to grow in number and complexity. Practitioners do not only need to have knowledge of tax laws, regulations, rulings, methods and requirements in a specific jurisdiction but also need a holistic view of international tax regulations, developments, especially changes in tax rates.

Tax rate is one of the key factors that impact Tax charges of any business. Thorough analysis of global tax rates can help businesses best managing and planning their global tax activities and positions.

DaTaxan has all cover for you, our below Free interactive Worldwide Tax rates Analysis will provide you a Free holistic view of global Direct and Indirect Tax rates, tax trend analysis in various countries, regions around the world over the past decade. With Microsoft Power BI, our analysis report is very interactive, dynamic and easy to use.

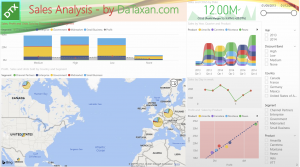

Tax Risk Management Tool

DaTaxan also develops Tax Risk Management Tool , which offers Businesses integrated, ‘Real-time’, AI powered Tax Risk Analysis with instant Tax Provision Balance & Tax Exposure Balance in Local Currency and auto converted Reporting Currency.

The report also auto calculates tax Profit & Loss impacts and generates journal postings for tax accounting purpose

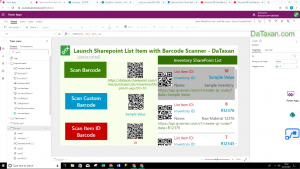

The DaTaxan TRM Power BI report can work as stand alone application with ability to connect to multiple data types/sources.

This DaTaxan TRM Power BI report also acts as a component of our DaTaxan Tax Risk Management Solution, bundles with Power Apps (Model Driven App and Canvas Apps), SharePoint and Microsoft Teams.

Should you need any additional or related information regarding Tax technology, feel free to reach out to us at contact@dataxan.com