World-wide Transfer Pricing Analysis

Transfer pricing rules and regulations around the world continue to grow in number and complexity. Namely: Country by country reporting (CbCR) under BEPS Action 13 by Organisation for Economic Co-operation and Development (OECD).

Practitioners do not only need to have knowledge of tax laws, Transfer Pricing (“TP”) regulations, rulings, methods and requirements in a specific jurisdiction but also need a holistic view of TP regulations, developments.

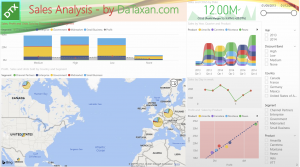

DaTaxan has all cover for you, our below interactive Worldwide Transfer Pricing Analysis will provide you a holistic view of global TP landscape. With Microsoft Power BI, Our analysis report is very interactive, dynamic and easy to use. The report covers all the following analysis just in single page:

- Multilateral Competent Authorities Agreement – MCAA Signatories

- Master File Requirement

- Local File CbCR Requirement

- CbCR Notification Requirement

- Contemporaneous TP Documentation Requirement

- Annual Benchmarking Requirement

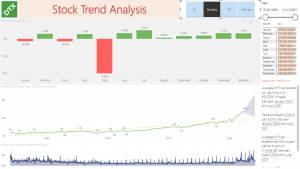

CbCR Risk Assessment Tool

DaTaxan also develops CbCR Risk Assessment Tool, which allows multinational Group to benchmark its own CbCR with OECD’s recent released Anonymised & Aggregated CbCR data

Should you need any additional or related information regarding Transfer Pricing, feel free to reach out to us at contact@dataxan.com