Increase deductible interest cap from 20% to 30% EBITDA

On 24 June 2020, Vietnam Government issued Decree 68/2020/ND-CP (Decree 68) amending and supplementing Decree 20/2017/ND-CP (Decree 20) on tax administration for enterprises having related party transactions.

The new Decree amends the net interest expense cap to 30% of total net profit generated from business activities plus net interest expense (EBITDA). As per Decree 20, the interest expense cap was 20%.

Net interest expenses to be carried forward for the next 5 years

The new Decree also allows the non-deductible net interest expenses within the tax period to be fully carried forward against the net interest expenses to determine the taxable income of the next five years

Scope of application

Add non-applicable cases for enterprises which incur borrowings social, public projects, or target projects of the Government

Effective Period

The new Decree is effective from 24/6/2020, apply from the Corporate Income tax period 2019. This Decree also applies retrospectively for the tax period 2017 & 2018. All the amount exceeding the 30% interest cap can be carried forward to net interest expenses in accordance to the new regulation to determine the taxable income of the next five years

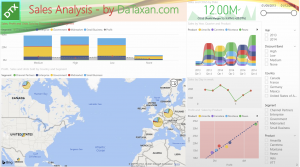

Contact us at contact@dataxan.com should you need any further advice or information.