Worldwide Tax rates Analysis Tax rules and regulations around the world continue to grow in number and complexity. Practitioners do not only need to have…

FREE Worldwide Transfer Pricing Analysis provides you a holistic, interactive view of global TP landscape: MCAA, Master & Local File, CbCR…

Updates on Vietnam New Transfer Pricing Decree – 132/2020/ND-CP replacing Decree 20/2017/ND-CP and Decree68/2020/ND-CP, effective on 5/12/2020

VIETNAM TRANSFER PRICING – Decree 68 amends Decree 20, increases deductible Interest cap to 30% EBITDA, effective from 2019, retrospective for 2017 & 2018

EVFTA has just been ratified by Vietnam and is about to take effect The European Union Vietnam Free Trade Agreement (EVFTA) and the EU-Vietnam Investment Protection Agreement (EVIPA) signed…

Finance-Tax ChatBot Experience our BEPS TaxBot. Ask any BEPS questions you like Our BEPS FAQ ChatBot can provide answer to Frequently Asked Questions (“FAQ”) on…

Multilateral instrument (“MLI”) Overview Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (“Multilateral Instrument” or “MLI”) is part of BEPS…

CbCR – Country by Country Reporting status analysis The OECD has shared information on the domestic legal frameworks for CbCR (under BEPS Action 13) around…

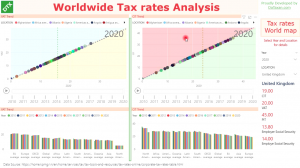

World Corporate Income Tax rate (“CIT”) analysis Corporate Income Tax rate (“CIT”) is one of the key factors that impact Tax charges of a business.…